Are you investing overseas?

How to maximise benefits and minimise risks

Are you someone who has a little extra income to invest somewhere? Are you looking for any option to invest? It is inspiring to know that 8 out of 10 millionaires surveyed revealed to have gained their wealth from investing in real estate. But what if there are too many hurdles to access the real estate investment sector in your own country? Would you consider investing abroad? Looking at the current projections, International real estate may bring a fortune to investors over the coming decade.

The media may somehow give a challenging impression about doing business offshore but there are real advantages on investing overseas that could help set you up to financial freedom sooner. Here, we explore the pros and cons of offshore investment along with a few guidelines.

The media may somehow give a challenging impression about doing business offshore but there are real advantages on investing overseas that could help set you up to financial freedom sooner. Here, we explore the pros and cons of offshore investment along with a few guidelines.

By investing abroad:

1. You may bring economic safeguard to your wealth

When you move your savings and wealth abroad, you are investing in different economic geographical land. Unlike an intangible financial account, your wealth is far enough not to be impacted by economic conditions of your home country.

2. You may enhance your international footprint

When you own a property in a foreign country, it doesn’t only provide additional revenues of income and growth, but may allow you more freedom in visiting and travelling that place. Sometimes, it can even get you immediate citizenship and a coveted second passport with visa to travel over 100 countries. Also, owning some wealth in a foreign country gives you the option to build your second home, potentially a place to retire if you desire so.

3. You can diversify your portfolio

Foreign real estate is always a tangible fixed asset that has diversified benefits over a traditional portfolio of stocks, bonds and precious metals, etc. It has the ability to generate cash inflows in a foreign country from rental properties and capital appreciation as well.

4. You may be eligible for certain tax benefits

By investing in foreign real estate, you may be eligible for tax credits in member countries for the tax paid in the other country. It is always a good practice and strategy to consult with your tax advisor on international tax provisions to structure it appropriately to your specific situation and objectives.

OTHER BENEFITS

Other Benefits include,

- Investing internationally opens a huge door of opportunities for you. Primarily, you will be able to access leading companies that are not available in your country. You can think of investing with some of the globally successful corporate companies like Westfield, Cochlear, BHP Billiton, CBA, Westpac, Telstra, etc. This could mean better return for you in long term investments.

- Most of the related growth industries such as hotel and commercial apartment sectors are found in countries booming with tourism such as Australia and Singapore.

- You face diversification when you invest in different countries and industries and this diversification teaches you different working cultures along with different opportunities and challenges. This diversification could ultimately help you protect your investment against sharp fall in a geographical market.

- Foreign investment gives you the opportunity to position yourself both in expanding and volatile market bringing greater returns.

- Today’s investment can be your tomorrow’s retirement plan.

- As per the rules of real estate, you buy with the hope to earn capital appreciation, but you can also buy for cash flow, which recently became an important agenda.

- Foreign real estate may be your holiday home, an investment that your family would be able to enjoy at leisure or it may finance your overseas visit.

HOW TO INVEST INTERNATIONALLY?

To invest internationally, one needs to evaluate the available options. Buying shares in overseas companies may be your first option, but this can be a complex process, as there could be currency exchange rate risks. Given you have done the necessary research on the market you are interested in, you could invest internationally through your super fund, that includes nominating an appropriate international investment fund for your account. You may also look at some managed funds which has international shares. A managed investment fund can be a safer option since it pools yours and others’ money for investment in international shares providing diversified investment options.

THE THEORY OF DIVERSIFICATION

It is impossible to pick the best performing investment options as it differs from year to year and place to place. Diversification is a wise strategy to cut down the risk factor associated with investments. It includes spreading your investment over various asset classes that includes shares, property, cash and fixed interest. By doing this, your return will not solely rely on one asset class.

The same theory applies when you think of investing in only one country. You can rather spread your investment across a range of industries in different countries. This would save you from losing everything if the country where you invest in suffered an economic crisis.

DIFFERENT TYPES OF INTERNATIONAL FUNDS

As per the diversification in investment, there are different types of investment opportunities.

Three major ones are explained below.

- Global Funds

These are the kind of funds that typically focus only on established markets like, USA, Europe and Japan. Global funds mostly aim at long-term growth and return by investing mostly in companies listed in major international share markets.

- Regional Funds

Regional funds concentrate on one particular region or a country. These funds are highly volatile since they are not diversified in nature.

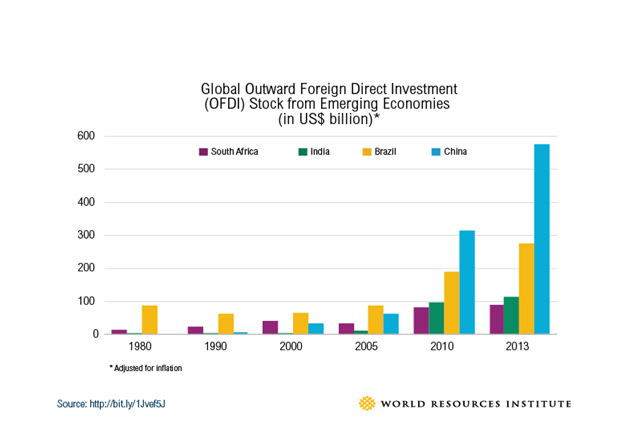

- Energy market funds

These kind of funds usually concentrate on investing in developing countries such as India, Brazil, Mexico, Korea and China etc. They are drawn in by the potential they see in investing in places experiencing higher rates of economic growth, but there are risks involved such as additional volatility and low rate of return.

ASSOCIATED RISKS

As with any kind of investment, there will always be some risks involved but it shouldn’t deter you from extending your investment horizon. We identify three major risks associated with international investment and the ways to mitigate them.

- Currency Risk

Investment in different countries always carries the risk of diversified currencies. Diversified currencies bring fluctuations which can be very harmful to your investment. Get some good knowledge about the fluctuations before you invest gracefully. For example, fluctuations in the Australian dollar can seriously affect return from foreign investments because losses or gains need to be converted into Australian dollars. There’s a process called hedging which can be used to reduce the effects of currency fluctuation.

- Market risk

International share markets are very much volatile in nature and subjected to sharp rises and falls. As an investor, you need to take help from professional investment management organizations to understand the subjected market conditions.

- Political and liquidity risk

The changing political scenario can have a big impact on a country’s currency, and values of overseas investment policies. Take for example, factors like change in economic policy, trade restrictions or nationalisation of industries, can lead to a downfall in the market and affect returns from foreign investments. Sometimes, trading internationally becomes difficult due to the reason that some overseas share markets have very low trading volumes in comparison to the primary markets.

INVESTORS’ PREFERENCES

Offshore investment options may help preserve your wealth and add on your legacy while simultaneously reinventing your life and securing your retirement. In this information age, it has become easier for an average investor to find out the appropriate country and sector to invest in. Thanks to global market events and the available resources online, one can do the necessary research and make educated decisions.

Eagle888 Ltd: Why Australia is a good option to invest

Australia is a great country to invest in because of its resilient economy and stable growth. This is our 25th year of steady uninterrupted growth, providing a safe, low-risk environment to do business and invest. The country’s economy is rated AAA by all three global rating agencies and is forecast to realise average annual real GDP growth of 2.9 per cent between 2016 and 2020. Australia has a powerful combination of solid economic performance, highly skilled workforce, legal and political stability and close ties to the fast-growing markets of Asia. We are proudly the sixth-largest country in land area and the 13th largest economy in the world with a multi-culturally diverse population of 23 million.

Australian investment property has an average return of 7.0% over 10 years according to ASX report. Investors are divided in choosing between residential or commercial property. While others believe residential is the least risky option, many serious investors see commercial property as safer option due to its cash flow potential. CoreLogic RP Data revealed that the residential properties’ average rental return across Australia’s capital cities is only about 3.6% compared to 8%-12% gross rental yield for commercial properties. With Australia’s booming tourism and strong growth of international visitors, Eagle888 Ltd particularly sees the potential of serviced apartments. The emergence of savvy travelers has started the trend to opt for a more flexible serviced-apartments rather than hotels. Serviced apartments offer similar services of hotels but with bigger space, more privacy and amenities that allow extended stays. They cost much less than average hotels especially on long-term stays, a factor that ultimately attracts more patrons. A recent study (Atchison Consultants Report) projects that serviced apartments will outperform hotels’ total returns within the next three years – with 13-15% return per annum for serviced apartments compared to 10-11% for hotels.

THE UNCERTAINTIES

Although the benefits are very enticing, we can’t deny the uncertainties related to offshore investment. The primary concern would be the cost and how to go about it. The cost depends on which country you are eyeing to invest but in general, an average investor can start investing from as low as $50,000-$100,000.

Like any kind of business, nothing is guaranteed in an investment. But investing is not just about taking risk for the purpose of future gains but also keeping the value of your assets. The term investment has always been understood as “purchasing something for its anticipated value in the future” but before they even deliver gains, investments initial purpose is “retention of wealth”. This means investment could serve as protection of your assets other than just a risky bait for gains.

Consider the following points when you want to invest offshore.

- The country is not a probable option for the next big economic decline.

- It is not likely to collapse to the demands of developed countries.

- It is not likely to impose laws on foreign-owned wealth and investments.

Essentially you need to do a proper check on the countries which can provide the best increased value on investment.

When investing internationally across multiple tax jurisdictions, we recommend you seek professional tax advice and structure your investment to meet your investment objectives and learn how to best manage your investment. If in Australia, we recommend seeking taxation specialist’s advice on how to best manage your investment such as ways to maximise returns and reduce risks.

You may first need to understand your taxation obligations in both Australia and your own country of residence to gauge if the investment is worthwhile. Also, the costs involved in seeking professional advice should be factored in decision making.