Why is there a need for Fund Managers?

Introduction

Do you believe some people are better at handling investments than the rest? What if you have the resources but not the skills? Would you like to know how a fund manager works?

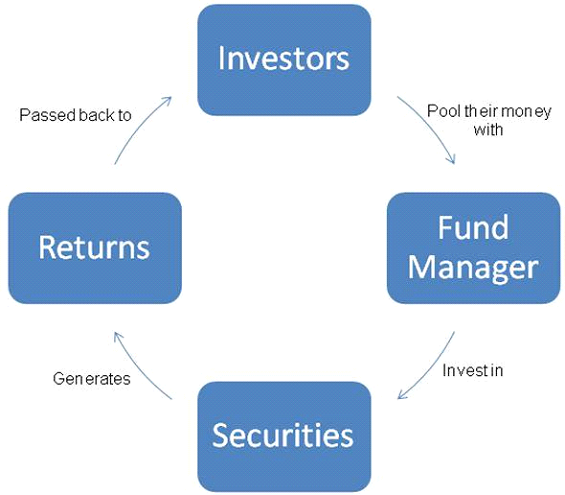

The main purpose of investing in a fund is to give the responsibilities of the investment management to the experts. This is why the knowledge level of the fund manager is one of the primary factors to consider when you evaluate the investment quality of a particular fund. The fund management could be a person or a group of persons who highly specialise in managing and implementing investment policies, fund’s strategies and goal orientated projects. The fund manager is behind all functions, starting from understanding customer’s objectives, risk appetite through to achieving returns for the customer.

It is extremely important that the professionals involved in fund management must have a high level of financial education, necessary professional experiences and hold mandatory licenses to provide such services. However, more than the education acquired from reputable institutions, it is best to look at the type and nature, accreditations and performance of the existing funds under the management. While the past performance may not guarantee future performance, it would give you an idea if the manager has developed a good instinct – a wisdom you can only grow through time and experience.

In this article, we will thoroughly explain the importance of fund managers and the implication of their skills in investment. The key highlights are as follows:

- Qualifications of a fund manager

- Roles and responsibilities

- Benefits and risks of investing in fund management

- Australia as a lucrative destination for investors

The responsibilities of a fund manager do not end at managing the investment. They also need to provide the necessary advice to their clients, individual or institution. They are responsible for tracking the current market trends and market return rate to give good returns to their clients. They also need to update the capital structure for balanced investment decision. To understand the volatile market condition, a fund manager must be qualified and eligible.

Educational Qualifications

A degree in commerce, economics, business administration or finance is must! A successful fund manager usually has an MBA or relevant post-graduate degree with specialisation in finance from reputed institutes. Additional courses run by financial organisations like stock exchange would provide an added value.

Personal Skills

A successful fund manager should be confident, determined and motivated enough to possess strong time management skills. He should be able to work under pressure with good problem solving skills. He should have good IT and analytical skills. More importantly, he would be a person of good character with excellent work ethics highly capable of communicating and building rapport with others. This comes very handy when the management needs to reach out to people to collaborate on projects.

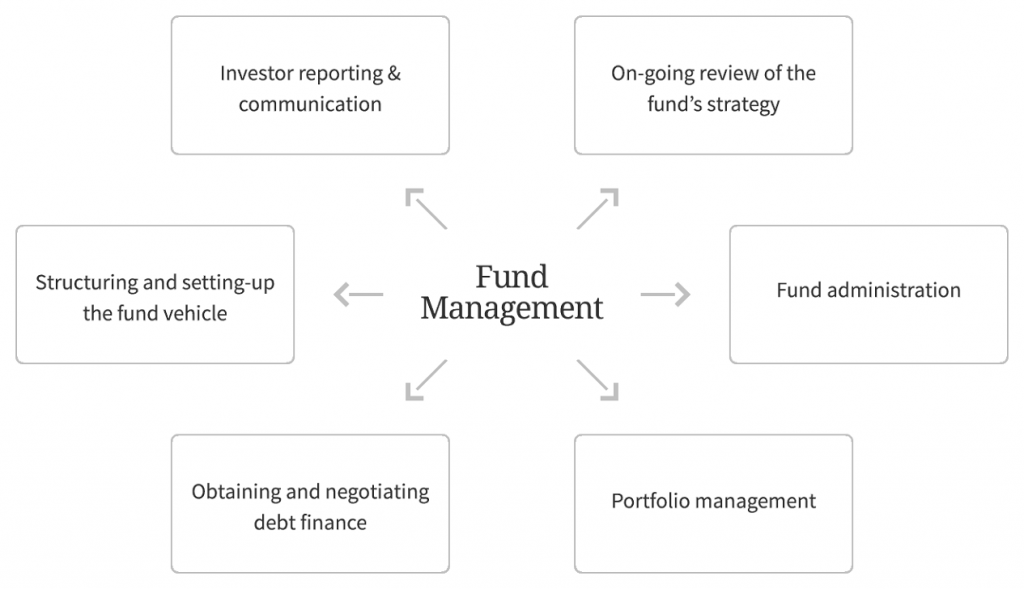

Roles and Responsibilities

Reporting

It is the duty of Fund Managers to satisfy the reporting requirements of their investors. The detailed statement of the funds’ strategies, objectives, risks, policies and expenses should be clearly outlined in a prospectus and legal documents compliant to the country’s regulations. Due diligence report keeps investors updated on how well their investment is performing and will give them a timely insight if it’s the best time to invest more or exit the fund.

Compliance

Funds are strictly operated under the regulations set by authorities such as the Securities and Exchange Commission. Regulations may have extensive coverage on the aspects of the fund’s business from acquiring investors and handling redemptions.

Development of the investment fund

The primary responsibility of the fund manager is to put client’s money into a sector that will generate gains. The choice of a fund manager depends on the client’s expectations and regulation norms. People turn to a fund manager in the desire of big returns hence fund managers’ efficacy is distinctly measured by the performance and the growth of the fund. At the minimum level, they need to provide the growth that at least exceeds the rate of inflation and interest rate.

Risk Management

Fund managers have responsibilities to protect investors’ money. All kinds of funds take a certain amount of risks to deliver growth, but that does not justify any reckless behavior from the fund manager. Henceforth, there is a lot of careful observation and research that needs to be done by the fund manager. That involves investigating business contacts, companies or assets, attending industry events and workshops and learning risk management techniques. They also make sure that asset portfolios are diversified enough.

Outsourcing and overseeing

The responsibilities of a fund manager may exceed his capabilities. That’s why many of them prefer to outsource certain duties to external firms. These firms take care of tasks such as negotiating with brokers, issuing annual reports or attracting capitals. Even so, the fund managers are still responsible for the outcome and growth of the funds and must actively participate in their given tasks

Managed funds deliver attractive investments

There are a number of reasons why you should consider engaging a fund manager to manage your funds. Basically, a fund manager takes all the investment decisions on your behalf, applying all their analytical skills and professional assessments. Rather than following the market rigorously and picking shares, you would be just deciding on the size of the investment you are going to make! The fund manager would regularly update you on your fund’s performance and he would give you professional assistance if you want to place your fund somewhere else.

Exclusive access to a wide range of investments

A fund manager can put your money in desired places and give you access to diverse investments. Usually, these investments are not available to you as an individual investor like the international shares and commercial properties. They may also have investments across a wide range of asset classes. You have the opportunity to find the type of managed funds that suit your own financial goals. If you want to play it safe, most managed funds give you the opportunity of regular investment option. Regular investment allows you to manage investment risk by dollar cost averaging into the market.

Investment that fits your budget with high value of liquidity

You can start a managed investment just by spending around $2,000-$5,000. It gives you the freedom of investing a small amount of money whenever it’s available. Managed investment has the ability to turn your investment into cash. So, whenever you want to raise some cash, you don’t need to sell a part of your investment.

Smooth paperwork and administration

Not many people are fully aware of the administrative and paperwork related to investment, it could be overwhelming for both first-time and seasoned investors and most often they would require a help from a professional finance advisor. There is less hassle in investing in a fund wherein a fund manager usually provides you a consolidated report on your investment transactions, balances, comprehensive income and capital gains tax information.

Risk management

Managed funds help you diversify your investment to reduce risk. And it can be done by spreading risk across various asset classes such as bonds, property, shares and cash, countries and stock market sectors.

As per the rules of investment, holding one investment compared to multiple ones can be riskier as not all kind react in the same way in different economic environments. If Asian markets are falling, European markets may be growing. If the manufacturing market suddenly gives you weak returns, the education market might give you strong returns. In this way, the risk of your investment can be reduced by keeping diversified portfolios.

Cost-effective

Fund management is a cost-friendly approach, since a fund manager puts your money in several funds and gives you a bigger access into the stock market. It is an expensive affair to buy individual shares since you need to pay extra to the brokerage.

Greater exposure

Managed funds can be a part of the geared investment strategy, as many of them fall on the list of approved products. The margin lenders usually don’t hesitate to provide loan against ‘approved products’.

Potential risks

- Unsatisfactory return

When you invest in a managed fund, you may have the liberty to invest in different asset classes and industry sectors but there is always the risk of underperformance of your fund, which may affect your return. - Undefined investment areas

Some fund managers may advice you to invest in specialized areas to take advantage of a highly potential growth opportunities. There is bigger risk if you decide to invest in narrow sections of the market so it is always a good practice to consult with an investment adviser outside the management to get a second opinion. - Professional fees

A professionally managed fund demands a professionally managed fee. The fund manager charges the fee in different ways- if the fund size grows, then the fee increases, as a fixed cost of the services provided by the fund manager. Some fees are deducted from the assets and if the fund’s value decreases, it is deducted from the income earned. If your fund underperforms, then these fees may reduce the overall return of your investment. - Currency fluctuations

Currency fluctuations can affect the value of your fund, especially if your fund invests in international shares. Certain asset classes are subjected to this risk.

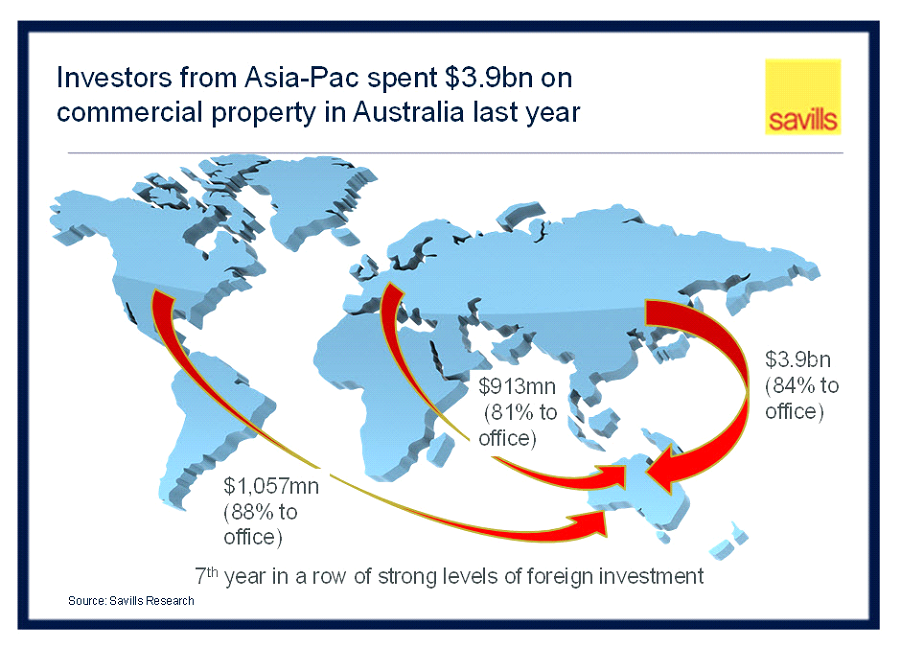

Investment Opportunities in Australia

If you are an investor looking for investment opportunities abroad, Australia may be one of the best choices you’ll find. Australia is one of the fastest growing economies in the world today, GDP rate steadily increasing since 1991 has resiliently survived both the financial crisis- Asian financial crisis (1998) and global financial crisis (2008). Its economic resiliency is more evident compared to other OECD (Organization for Economic Co-operation and Development) countries. In 2013, Australia’s unemployment rate is in the lowest 25% amongst OECD countries and its debt to GDP ratio was 34% as compared to USA at 106.5%, UK at 111.6% and Germany at 80.9%. There is growing potential since Australia attracts hundreds of millions of customers from the Asia Pacific markets due to its rich natural resources, transparent business policies and substantial pipeline of projects. The Australian government is providing special concentration to its infrastructure development since 2014 onwards and an estimated amount of $125 billion is awaiting to get invested. The buoyant economy, increasing number of outside population and increasing freight volumes create huge opportunities for investors planning to invest in sectors like healthcare, finance, entertainment and transportation. Australia’s property market is also regarded as one of the lucrative property markets in the world. Last year, China invested close to A$7 billion, followed by Canada with almost $5 billion and not far behind was the USA with $4.5 billion in total. Another $7 billion was invested from other countries such as Singapore, UK, Malaysia, South Africa, UAE and Germany. These rates are likely to increase with strong return in investment. In its international economic engagement, Australia aims to build greater prosperity for Australia and the world.