Investment Trends- What Lies in the Coming Future

Putting funds in investment and handling are two different things. There is the risk of incurring losses if the investment is not handled correctly. The market changes every now and then, and that’s why it is important for both investors and fund managers to be updated with the latest investment trends and benefit from the knowledge. The market has seen a lot of trauma in recent years- the crisis in Greece, the wars, US political gridlock, slowdown scares in China, the fall of oil prices and migrant flows, to name a few. But the good news is that matured investors who allows for volatility in the market have seen good returns.

The future and beyond

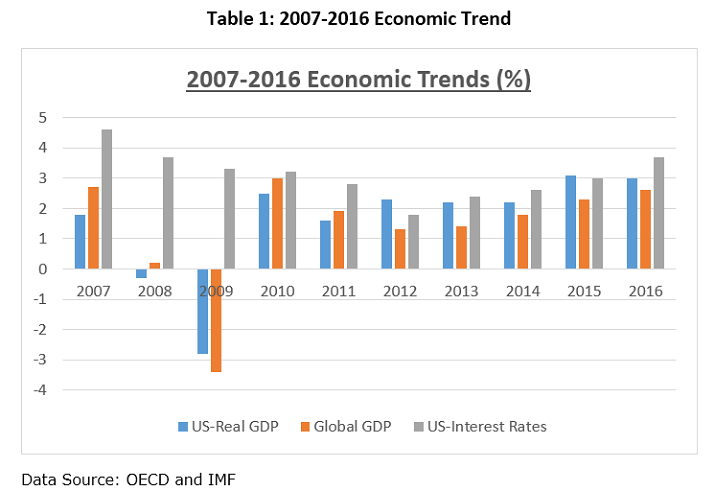

The future is not bleak at all. The global economy is not facing any severe slack, banking systems are healthy and debt levels are good. Developed equities have satisfactory valuations and consolidating oil prices should allow earning shift from last year’s negative to high-single digits. Developed equities and credits are well-placed for an another year of considerable returns. The developed economies will reflect a trend-like growth in 2016, while the emerging countries will show slow growth because of the imbalance between domestic and external factors. Inflation is likely to remain low.

Source: John Freeborn, LinkedIn.com

When it comes to investment, it doesn’t matter whether you are saving for your retirement or for a college saving. Smart investment plans could help secure you financially. Having no savings is worse than investing some money to experience good and bad days. This is because even if you lose some time atleast you gain wisdom in the sector and make smarter choices next time. Some people are now familiar with the value of their money – spending less, maximizing tax-free savings accounts, and putting some amount as an investment fund. If you’re on of them, then it may help you to implement smart investment trends to increase growth in those investments.

So, what does the future hold for you? What are the best trending investment ideas? Here are some smart investment trends that you may want to review to help you put your money in the right place. Read on to get a professional perspective on six of the most promising futuristic investment trends.

Futuristic trends

- The rise of investment tools

Investment tools are machines that can be used in (but not limited to) full-fledged trading, saving, investing, and retirement plans. You also get access to basic charting that helps you check the current price relative to periods of time. It helps you gauge for the right timing.

- Returns will be hard to come by

It is the most important trend to look out. We are in a state of low return rate across many verticals. There are also very few places to take refuge from losses. The traditional asset relocation methods used by the investors won’t work in the future. Also, there is less expectation of equity beta to grow, which is often taken as the primary source of return.

- Technological disruption

Technological disruptions are changing the fundamentals of business and economics and this has a great impact on inflation, interest rates, productivity and growth. We predict that economies and markets are getting prepared to face this technological change, as they are very real and has started to impact on businesses. Cash flow dynamics are getting reformed at corporate, industry and national level.

- Changing demographics

Demographic trends are acting right in front of us as. As the aged population rises, there is a sharp decline in the working-age-population in the developed markets and it’s going to have a huge influence on the trajectory of the world economics. The regions with less favorable demographic profiles will be heavily affected.

- Investing higher in the capital stack will make sense

We predict that investing in higher capital stacks in developed countries will make sense in the future. Especially, places with reduced liquidity, elevated market volatility and growth. However, late-cycle dynamics and stresses in commodity prices will result in default cases.

- Megatrends

There are four primary megatrends that have reshaped the industry- changing demographics, resource shortages, technology and progressing social behavior. Most of the other trends are directly or indirectly related to them. In the end, it’s all about the industry caring for the changing needs of the client, and it will be very different in the coming future. The future breed of investors will be much more connected to many different communities through social media and other forms of communication and will be more open to put their money on new commodities. They will be more savvy and trend and risk -educated than the present breed of investors.

Conclusion

We have occasionally observed market’s ruthless way of dividing businesses that may no longer be able to support existing leverage levels. There should be implementation of new disruptive technologies and business environment. The upcoming changes are dynamic and as an investor, you will surely want the capital to be placed on right side of the environment.

Reference: