Australia- A Haven For Global Investors

Australia successfully emerged from the 2008 global financial crisis with a stable economy and today, it’s regarded as a tempting target for foreign investments, business, and retirement.

The global economy has had a sudden fallout in 2016! There are predictions of market consensus and now has equities flat to negative. Blame it on the numerous price hikes and the end of QE (Quantitative Easing Policy) by the Federal Reserve in the US. Next comes, China and a potential freeze on oil. Global bond fund managers are bracing for drought and companies have been sidelined. According to Barclays indices, this is the worst performance since 2008 as US bonds slid 4.5 percent in 2015.

Link to the graph: https://ig.ft.com/sites/when-rates-rise/#what-is-happening

Over the coming time, investors can expect stock prices to appreciate only on average by mid-single-digit percentages. “Volatility is likely to rip through financial markets in the first half of 2016. Today’s turbulence is only the beginning,” states Nigel Green, CEO of deVere Group, a financial advisory firm based in the U.K. The whole world is eyeing on China since it has seen a big transition from a fast-growing manufacturing economy to a slower-growing consumer-driven one.

So, what should investors do in 2016? At first, they should follow the basic principle- save and invest for their desired goals, unaffected by the fear of return, as the equity portion of their portfolio is diminishing again, the confidence in bricks and concrete is emerging again.

Real Estate wins the race!

So, what’s the most predictable medium of Return On Investment this year? According to a study conducted by Colliers International, real estate would become the primary reason for the investment. According to Colliers Global Investor Outlook 2016, investors will keep a positive attitude towards the benefits of investing in a property. Another study by Real Capital Analytics predicts revenue of $625 billion earned from direct property investment worldwide, which represents an 11% increase over the same period of 2014. They have expected it to be doubled-up this year.

A win for the real estate investment vehicle demonstrates overall health and soundness of the economy including political stability, government policies, innovation, population, employment and business confidence which are further explored in this article. An investment overview in big cities ranks Sydney among the top few destinations.

Source: http://www.ey.com/GL/en/Industries/Real-Estate/ey-trends-in-real-estate-private-equity-2016

“Our report suggests that… long term secure investment in core markets will be the norm,” says John B. Friedrichsen, CFO of Colliers International. “Large volumes of capital already raised will increasingly seek out opportunities in tier-two cities and in recovering markets.”

They have surveyed more than 600 investors and 52% of them showed their inclination towards the benefits of investing in property. The participants had clear investment objectives and their preferred places to invest were, London, Paris, New York, San Francisco, Tokyo, and Sydney. Over the next 12 months, these places are projected to remain as the primary targets for cross-border real estate investment.

Benefits of investing in property are huge and many people take it as the key vehicle for their post-retirement saving plan. Seth Kaplowitz, an attorney with Blumberg Law Group and lecturer at San Diego State University, points out Los Angeles and San Francisco as the red hot choices for investors.

Source: http://urbanland.uli.org/capital-markets/uli-forecast-shows-positive-though-slowing-growth-commercial-property-prices/

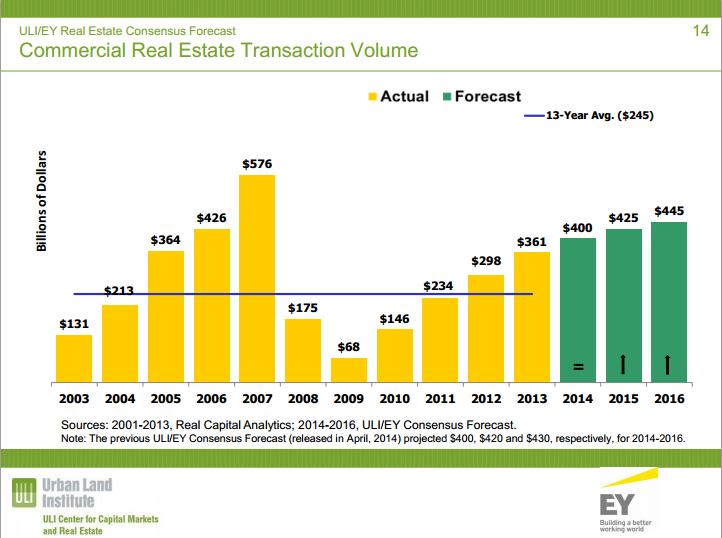

Martha Peyton, head of global real estate strategy and research at TIAA-CREF, thinks that the recent trend reflects more confidence among real estate investors and that’s one of the primary reasons to invest in 2016. The Commercial property transaction volume is expected to grow at a good verge, volumes have remained well above historical averages, and the 2016 estimate of $445 billion would be the highest volume ever projected, save for the inflated pre-financial crisis peak of $576 billion in 2007. Global transactions are also expected to exceed 2014 levels and will approach pre-financial crisis levels in 2016, according to Colliers’ estimate.

Ironically, despite the prevailing high-risk factor in the world economy, real estate buyers are keen on showing positive reasons for investing. In case fixed income may fall, rental and lease rates may act as the saviors. This is why the benefits of investing in property are always beneficial in most world-class cities.

Big Cities act as preferred locations

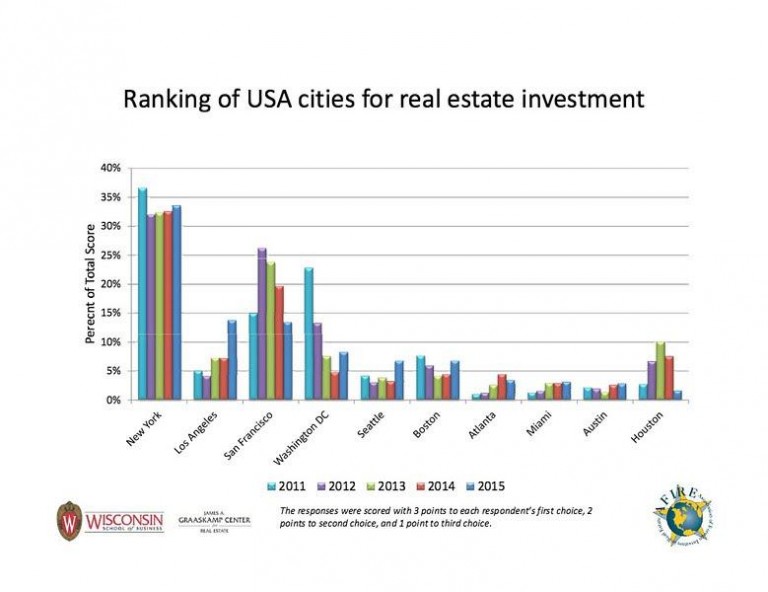

According to Colliers survey, San Francisco (27%), New York (24%) and Los Angeles (22%) remains as the preferred locations to invest within the U.S. Logistics, such as warehousing, office space, and shopping malls are the top three candidates for increased investment this year.

Source: http://www.moderncities.com/article/2016-mar-foreign-investment-growing-in-us-real-estate-for-2016

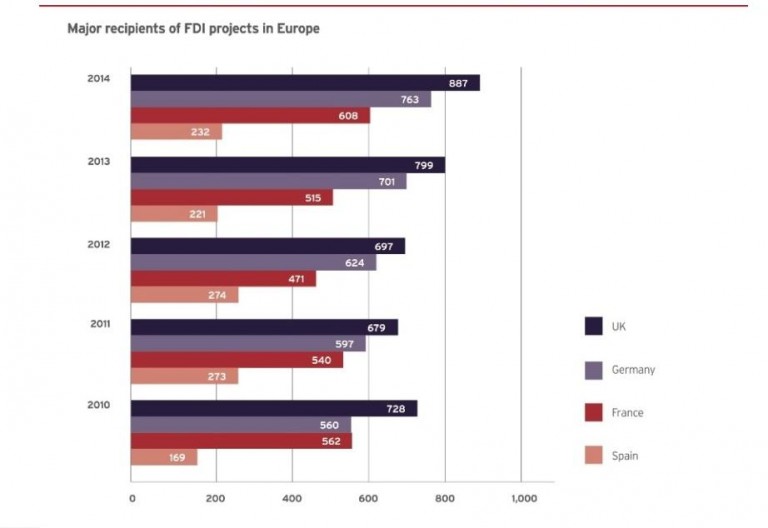

In Europe, London (43%) takes the lead, followed by Paris (19%) and Frankfurt (14%). Offices, shopping centers, and luxury retail are among the top three investments in continental Europe while U.K.-bound investors are after office space, logistics, and residential properties.

Source: https://www.gov.uk/government/publications/ukti-inward-investment-report-2014-to-2015/ukti-inward-investment-report-2014-to-2015-online-viewing

In Asia, Japan and Australia take the leading role among investment capitals, followed by Hong Kong, China, and Singapore. The top cities are Tokyo, Sydney, and Melbourne. And within the emerging Asian markets, Beijing and Shanghai topped the list. Office space, residential and logistics are some of the biggest targets in those markets this year.

Australia as the next big thing!

Why invest in Australia? Australia has its 25th year of uninterrupted annual growth. and its economy is the world’s 12th largest. The country is also regarded as an important contributor to five sectors expected to drive future global growth in agriculture, education, tourism, mining and wealth management. Investment opportunities in Australia are quite high since it offers a very favourable combination of strong economic growth, legal and political stability, a highly educated labour force and well-connected ties with Asia. The country’s economy is rated as AAA by all there major global rating agencies and is expected to reach a GDP growth of 2.9 percent between 2016-2020.

Australian government welcomes foreign investment with transparency and provides them with a well-regulated business environment. Its stable political environment provides confidence and security to the investors. For the last seven years, Australia has ranked amongst the global top five in terms of economic freedom and stability.

Highlights of the financial sector are;

- Considered as the world’s fourth-biggest pension pool

- Has strong market turnover predictions

- Considered as the third largest liquid stock market in Asia, after Japan and China

- The value of Assets is more than A$7 trillion, over four times Australia’s nominal GDP

The Australian Central and state governments provide a lot of support to the investors to set up and run their business considering location, nature and the type of industry of the business activity.

Source: https://www.austrade.gov.au/images/UserUploadedImages/3766/BM2016-SECTION-4_pg41.jpg

The reasons that call for major foreign investments

- Growing Economy

The Australian economy is declared as the 12th largest in the world in 2015, despite the fact the country is home to only 0.3 percent of the world’s population. Australia’s nominal GDP is estimated at US$1.2 trillion and accounts for 1.7 percent of the global economy. Australia is doubling the value of its total production every year. For investors, this may be the top reason to find Australia as an ideal location.

Info link: Australia-Benchmark-Report.pdf

- Australia has the highest growth among the advanced nations

In terms of economic growth, Australia has outperformed its peers for the last two decades. And according to the IMF, this will be a continuous process. Australia is expected to achieve average annual real GDP growth of 2.9 per cent between 2016 and 2020 – the highest among major advanced economies and up from an average growth rate of 2.7 percent between 2011 and 2015.

Source: http://www.tradingeconomics.com/australia/gdp/forecast

- The Asian region will be accountable for over 40% of the global GDP by 2020

Australia is a part of and has strong ties within the rapidly growing Asian region. It is expected that by the year 2020, 43% of global output will be rising from the region, which is more than double the ration in 1980. The combined economies of China and India will likely represent 28% of the world’s GDP.

Image Source: Australia-Benchmark-Report.pdf

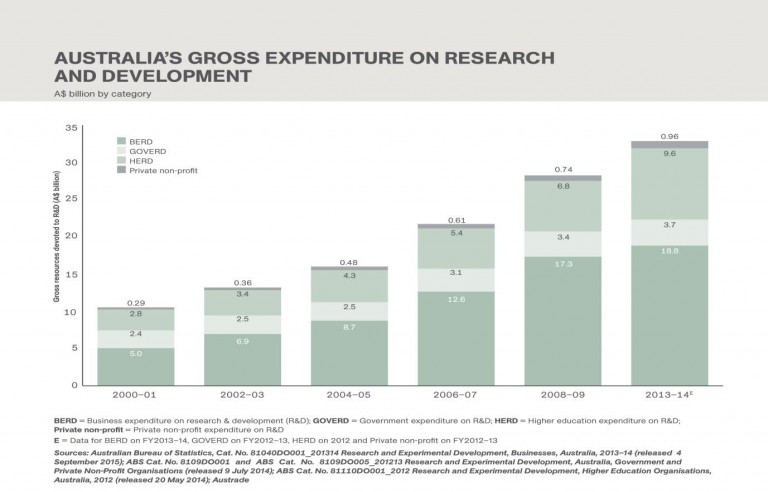

- Focus on innovation

Australia provides state-of-the-art ICT infrastructure, generous research and development (R&D) tax incentives for businesses, a high percentage of interest and strong intellectual property protection. Australia is committed to innovation and science since these are essential factors to maximize the country’s economic growth, competitiveness, and job creation. Between 2000–01 and 2013–14, Australia’s annual gross R&D expenditure rose by 9 percent per annum. Business Expenditure on R&D accounts for 57 percent of Australia’s total R&D expenditure, expanding from A$5 billion in 2000–01 to A$19 billion in 2013–14. This represents a compound annual growth rate of 11 percent, well above Australia’s nominal GDP growth rate of 6.4 percent.

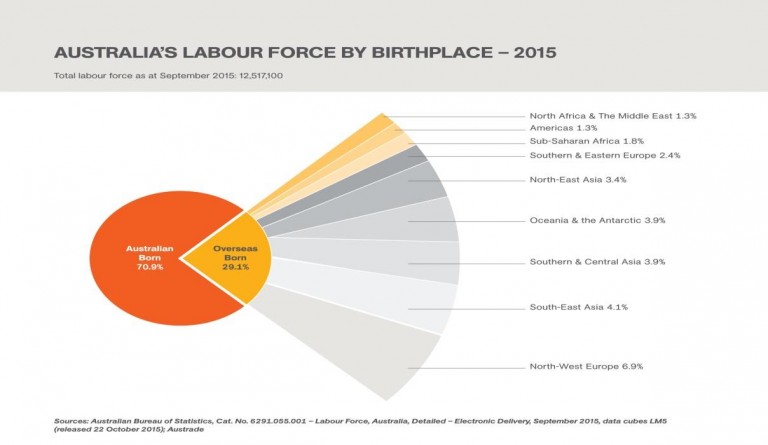

- Talented and multi-cultured labour force

Australia has a diverse workforce where almost 30% of workers were born overseas. Australia is one of the most culturally diverse countries in the OECD (the Organization for Economic Cooperation and Development). Out of the total population, around 2.1 million speak an Asian language and 1.3 million speak a European language in addition to English. This is one of the major reasons why International business houses are setting up their workforces in Australia.

The time zone for Australia favours the service industry as Australia can respond timely as Australia works when the rest of the world sleeps.

Source: https://www.austrade.gov.au/International/Invest/Why-Australia/Talent

- The property market value is valued at 4.8 trillion

http://www.macrobusiness.com.au/2013/07/australias-huge-property-market-gets-bigger/

The value of the Australian housing stock had hit around $4.8 trillion at the end of 2012.

According to RP data shown above, Australia’s total GDP was $1.49 trillion in the year to December 2012, that means that Australia’s housing stock was also nearly 3.3 times the size of the Australian economy.

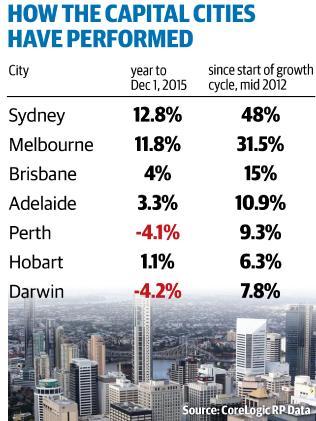

Last year’s figures

According to the data provided by CoreLogic RP Data in 2015, a few major capital cities saw skyrocketing values – a rise in the southern capitals of Sydney and Melbourne and a downhill slide in the resource rich capitals of Perth and Darwin.

Source: http://www.news.com.au/finance/real-estate/is-2016-the-year-youll-make-a-killing-in-the-property-market-the-experts-give-us-their-2016-predictions/news-story/075d3ebca1a3f37196974df4fde89364

There are property experts who forecasts for the property market in 2016. “The good news is that the market is cooling. I think that is terrific because as far as Sydney and Melbourne are concerned, we don’t want these high increases to just continue because that will lead to a correction”, says, John Symond – Aussie Home Loans.

Future expectations

According to data derived from the Q3 National Accounts 2014, the household wealth in Australia roared to its highest ever. Apart from land and dwelling prices, wealth grown in currency, equities and deposits contribute a substantial amount to this data. The most recent demographic statistics projected Australian population to increases by 378,476 people over the year and the majority of the growth takes place in major locations like Sydney, Melbourne, Brisbane/south-east Queensland, and Greater Perth.

Source: http://www.tai.org.au/sites/defualt/files/Australia%20Institute%20-%20Population%20Growth%20V3_0.jpg

Sydney takes the lead

Among the major locations, Sydney is regarded as the densest city with more than 8000 people per square kilometre. Sydney is surrounded by the Pacific Ocean and National Parks, which is one of the major reasons for growing investment opportunities. The size of a city’s population is an important factor for international finance centres to show interest in investment. The cities that have the ability to grow their population will outperform others. A new study by the Centre for International Finance and Regulation (CIFR) has ranked Sydney as the tenth largest international finance centre. This data is derived from investment banking fees billed from cross-border deals. Sydney has joined the league of global financial hubs along with London, New York, and Hong Kong, etc. The study suggested that to support the status of Sydney as a growing hub for foreign investors, all levels of government encourage organisations to centralise their operations within a dominant part of the city.

The study also cited Sydney’s performance was driven by its EU membership, workforce flexibility, top educational institutes, the presence of a stock exchange, the concentration of investment banks and professional service firms, and the ability to enforce contracts. Along with Sydney, the eastern suburbs are starting to set remarkable prices. Experts predict a growth of 5% for the harbour city. Foreign investment has become one of the strongest forces in driving up prices over the past six months, the property industry believes. The Australian Property Institute Property Directions survey found that 96 percent of respondents feel that foreign investment is the significant force behind it.

The Australian Government always encourages productive foreign direct investment. As it has been continuously contributing to economic growth, innovation, and prosperity. The Australian Foreign Investment Review Board (FIRB) reviews most of the foreign acquisitions to maximize the investment flows. And once approved, foreign investors are generally treated the same as domestic investors under Australia’s laws.

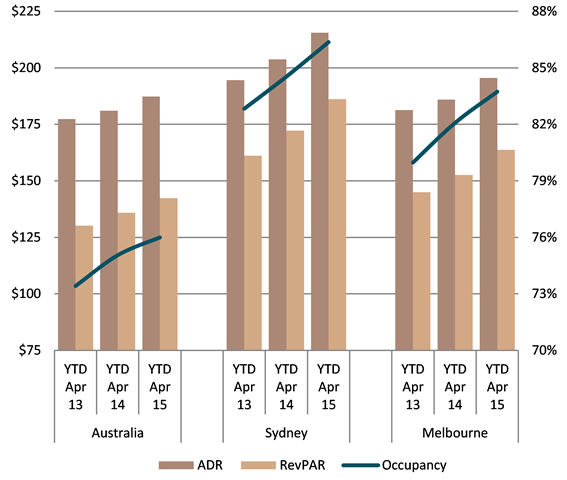

The accommodation sector kicks-in!

Currently, the lower Australian dollar is influencing more and more Australian natives to holiday at home. The number of international visitors reached a new high of 7.12 million during last year and it is expected to remain constant in the upcoming summer holiday season. Also, the spending by international visitors grew by 1 percent to a whopping record of $33.4 billion last financial year, and it is recorded as the strongest year-ending after the Sydney Olympics.

This new trend has influenced a lot of foreign investors to invest in Australia as it indicates hotel property capitalisation. Most of the overseas investors are showing their interest to invest in prime CBD locations. Sydney is again the primary choice for the offshore investors. A significant number of high-profile hotels are already sold and Melbourne is likely the next target for the investors to invest in Australia. So far, more than 14 hotels are sold in 2015 with values bigger than $50 million. And five of those over $100 million.

An analysis by STR Global for the year 2015 says that the average occupancy rate across the major city hotel markets stands at 75.8%. The highlight of the analysis was Sydney again at 87.1 percent, followed by Melbourne at 85 percent.

Source: http://www.knightfrankblog.com/commercial-briefing/blogs/record-number-of-tourists-entering-australia-with-chinese-visitors-leading-the-growth/

Chinese and South East Asian buyers are strongly investing in the highest priced assets in core Sydney and Melbourne hotel markets, and there is no sign of it slowing down soon. Hardly anyone can dominate the Asian buyers when it comes to the purchase profile of the Australian hotel investment. The strong presence of Chinese investors has continued in 2015 following their prominence in 2014. In 2015, Chinese investors have purchased nine Australian hotel assets worth over $811.8 million, accounting for 33.2 percent of total transactions by value. The next prominent investors were from Singapore, who have purchased over $681.3 million worth of hotel property in 2015, making up 27.8 percent of sales. The local investors were able to make 23.5 percent of transactions by value, with $574.6 million worth of investment. The most recent priced possessions are as follows, the $445m sale of the Westin hotel to Singapore based developer ‘Far East Organisation’ and ‘Sino Group’ from Hongkong and the $442m sale of the Hilton Hotel on George Street, to Singaporean Investment House ‘Bright Ruby’. In 2014, Sunshine Insurance Group from China has bought Sheraton on the park for a whopping amount of $453m.

Info-graph link: Hotel Research And Forecast Reports

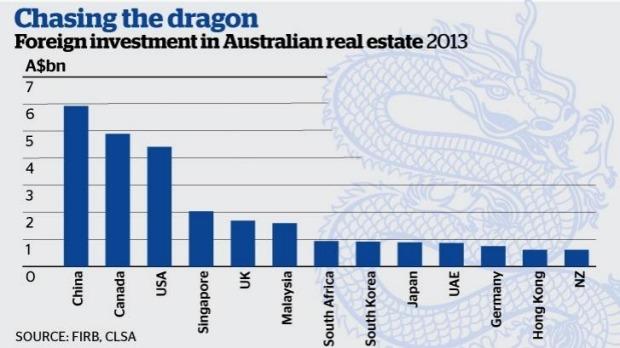

Australia – The strongest hub of destination for Asian investors

Recently, iProperty- Asia’s No.1 property site, has labeled Australia as the top pick for South East Asian property buyers. As briefly explained about their interest upon the hotel industry above. This data is obtained from the recent iProperty.com Asia Property Market Sentiment Survey for the second half of 2015. According to the report, Singaporean and Malaysian investors labeled it as their first choice, followed by Indonesians list it second. According to the Foreign Review Investment Board, Malaysia and Singapore were the fourth and fifth largest source countries for approved Australian property investment, after China, the United States and Canada. Hong Kong is also among the top 10 countries at number eight.

Source: http://www.smh.com.au/business/chinese-investors-are-pushing-into-melbourne-and-sydney-20141010-113q7x.html

According to Georg Chmiel, CEO, iProperty Group, there is a range of factors that influence Asians to choose Australia as their primary destination to invest. “The main reason Singaporeans and Malaysians are interested to invest in properties in Australia more than any other country is their perception that it is a very good investment compared to other countries,” Mr. Chmiel said. He elaborated that the survey findings also revealed that private condominiums or serviced apartments, followed by terrace houses, are the most sought after property types in Australia from these buyers.

Australian Financial Review reports that “ The surging increase in Chinese tourism internationally – for example, is one more reason why Chinese companies are keen to acquire international hotel chains and resorts.

The source of global investment flows into Australia has been changing rapidly over the last two years. The Asian countries now dominate two-thirds of total property investment, only one-third is overtaken by other countries. The capacity of large Asian firms is expanding every year. As they are self-financed, they have the ability to build and sell properties at Sydney and Melbourne to overseas buyers and it has rapidly changed the dynamics of the property market in Australia.

Colliers International research states that, when other developed countries are facing a recession, Australia has witnessed strong economic growth. For this reason, the local property sector has become the primary target for many offshore and local investors.

The South East Asian investors’ interest upon Australian commercial property has prompted the trend and it’s just the beginning. According to RP data, Australian dwelling values rose 9.3 percent over the 12 months to September. Sydney’s homes rose 14.3 percent and Melbourne’s 8.1 percent over the same period. Australia’s exuberant property market shows no sign of aging, pushed by fierce competition and local and international investor’s enthusiasm.

Conclusion

In the near future, an interesting trend to look out for will be local and offshore investors moving up the risk curve into either secondary CBD assets or metro office markets. The roller coaster of investment in Australia is showing signs of strong acceleration with recent free trade agreements with neighbouring countries in Asia. Australian policy is to remain neutral in international political areas making Australia a prime destination for safe investment, growth, security, and standard of living.