The Growing Need For Aged Care Centers In Australia

Introduction

Introduction

Aged care is a very important sector, governments across the world have acknowledged the need of living holistically and carefully. Australia will need 76,000 residential aged care facility by 2023-24 which is more than 100 beds each month. Australians are living longer than ever before! The life expectancy in Australia was 75.8 in 1984, and today it moved up to as long as 80 years for a male and 84 for a female. It is expected to increase to 90.4 by 2044! There is a growing demand for the aged care sector and in the coming years, the demand will only grow. At the same time, the aged care sector is facing trouble as half of the workers will retire in the next 15 years. By 2044, the number of over 60s would outnumber 18s. With the increase in life expectancy, a bigger demand for aged care services arises in Australia.

The Australian government on its own cannot provide the funds and human resources to meet all the needs of its ageing population and calls upon the private sectors to step in. Likewise many countries, including China, introduce immediate policies that address the concern for the ageing population and invite private sector to propose solutions that will equally benefit them.

In this article, we will elaborate the following points

- ERP (estimated resident population) of Australian states, median ages, mean ages, sex ratios and their impact on Australian aged care industry

- Increasing life expectancy rate and the factors influencing it (enhanced public health infrastructure, health campaigns and better emergency care services)

- The impact of increasing life expectancy on the Australian aged care services

Median Age

For the last two decades, Australian median age, the cohort at which half of its population is older and half is younger – has increased by 4 years. It was recorded 33.4 years in 1994 and 37.3 years in 2014.

On June 30th 2014, Tasmania had the oldest median age of all the states and territories (41.6 years), followed by South Australia (39.9 years). The Northern Territory had the youngest median age (31.8 years), followed by the Australian Capital Territory (34.9 years).

Ageing Population

Australia has an increasing number of ageing population strongly associated to its sustaining low fertility and increasing life expectancy. As a result, a major share of the total population is occupied by those aged 65 and over. Comparatively, there are fewer numbers of children aged under 15 years.

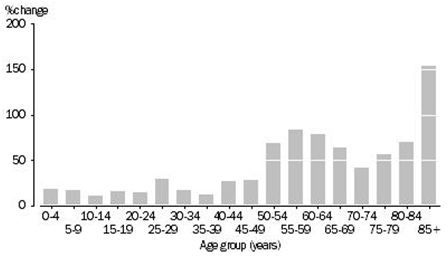

Population Change, Age group – 1994 to 2014

Between 1994-2014, the number of people aged 65 years and above increased from 11.8% to 14.7% and the number of people aged 85 years and above almost doubled up. On the contrary, the number of young citizens aged under 15 years decreased from 21.6% to 18.8%.

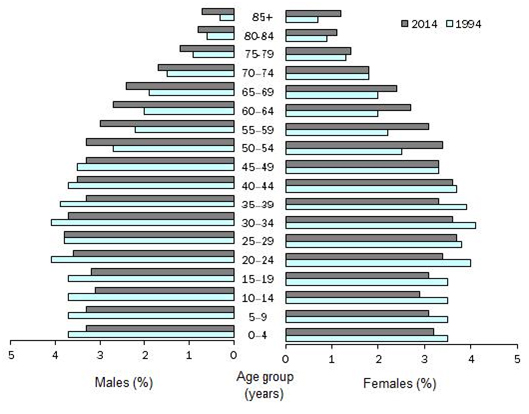

Population Structure, Age and sex – Australia – 1994 and 2014

Children (Aged 0-14 Years)

Between 1994-2014, the number of children aged 0-14 years decreased from 21.6% to 18.8% of the total population. As per the data recorded on 30th June, 2014, the number has increased by 1.2% (52,000 people) as compared to the previous year’s 1.6% (70,400). Among the places, the Australian capital territory recorded the highest increase (2.3%), followed by Western Australia 1.9%). While Tasmania recorded a reduction of 0.6%.

Working-class Population (Aged 15-64 years)

The working-class population (aged between 15-64 years) was 66.6%. It increased to a new high of 67.5% in 2009, but declined to 66.5 in June 2014. There were around 285,000 citizens aged 15 years who entered working-class population, while 235,000 people turned 65 years and left the working-class population in June, 2014.

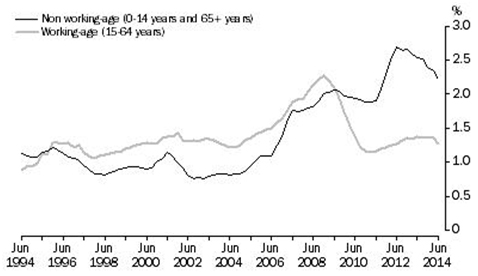

WORKING-AGE AND NON WORKING-AGE POPULATION ANNUAL GROWTH RATE COMPARISON, Australia –on 30th June, 2014

Over the last 20 years, the non-working age population is growing faster at 2.2% as compared to 1.3% of the working-class population. The population aged 65 and over are the highest contributors to the non-working age population.

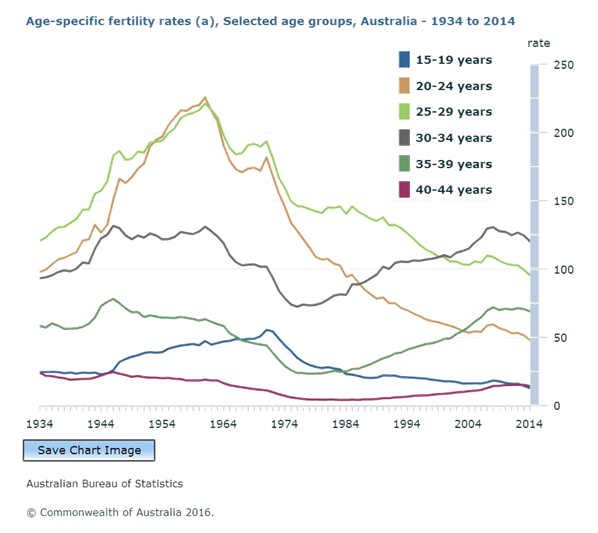

Fertility Rates

Since 1976, Australia has seen a decline in total fertility rate (TFR). TFR is the average number of babies born to a woman throughout her reproductive life cycle. And the number has been showing a significant drop over the years. In 2014, the TFR rate was 1.8 babies per woman, which is a decrease from the 2013 TFR rate of 1.88 babies per woman. The expected TFR required to replace a woman and her partner is around 2.1 babies per woman.

Footnote(s): (a) Births per woman.

Source(s): Births, Australia

Between 2013-2014, women aged 45-49 years showed increased fertility rates. But all other age groups have shown decreasing rates. The rate remained highest for women aged 30-34 years with 120 babies per 1,000 women; which is less than 125 babies per 1000 women in the previous year. The teenage fertility rate decreased with 13 babies per 1000 women.

Footnote(s): (a) Births per 1,000 women.

Source(s): Births, Australia

Life Expectancy

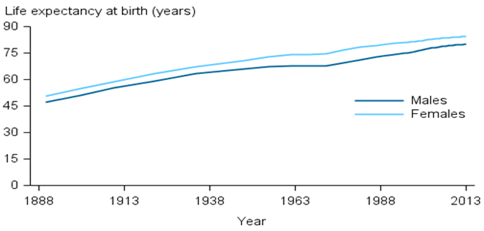

The Life expectancy rate basically measures the average mortality rate of a person based on current age and sex-specific death rates. It is the most commonly used measure to reflect the overall mortality of a population. Since the last century, Australia has seen a steady growth in life expectancy rate. Boys and girls born in 2011-2013 can expect to live around 33-34 years longer than their elders.

The figure shows a comparison of life expectancy at birth by sex in the following periods, 1881-1890 to 2011-2013.

The figure shows a comparison of life expectancy at birth by sex in the following periods, 1881-1890 to 2011-2013.

Source:aihw.gov.au

A boy born in 2011-2013 can at least live to the age of 80.1 years, while a girl can live to 84.3 years compared to 47.2 and 50.8 years respectively in 1881-1890. Life expectancy changes over a person’s life as he grows older and it can be presented as the expected age at his death. The life expectancy of men aged 65 in 2011-2013 was 19.2 years and the life expectancy of women aged 65 in 2011-2013 was 22.1 years. Australia has one of the highest number of life expectancies compared to any other country in the world.

The reasons for increasing life expectancy

Source: aihw.gov.au

Enhanced Public Health Infrastructure

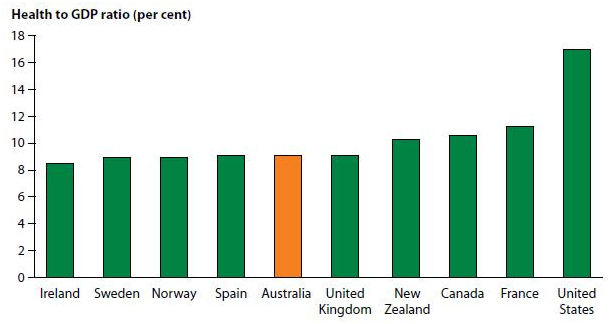

Australia has one of the most advanced health care system in the world. During 2011-2012, spent around $140.2 billion on health care industry, which is 1.7 times higher than in 2001-2002. During 2011-2012, the health expenditure per person was around $6,230 compared to 4,276 per person in 2001-2002. The health expenditure rate has grown higher than the overall GDP rate. Over the last decade, the total health expenditure has grown at an average rate of 5.4% while GDP has grown only at a rate of 3.1%.

Source: AIHW health expenditure database.

The figure represents total health expenditure to GDP ratio, 1986-87 to 2011-12

Australia’s health expenditure to GDP ratio is slightly higher than any other OECD country. Health care is regarded as one of the biggest part of the economy.

The figure represents Health expenditure as a proportion of GDP, selected OECD countries, 2011

Source: AIHW 2013a.

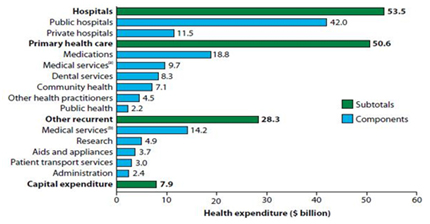

Australia, mainly concentrates on four broad areas of health spending: hospitals, primary health care, other recurrent expenditure, and capital expenditure. During 2011-2012, the biggest spending was for hospital services, by both public and private providers- $53.5 billion, or 38.2% of total health expenditure.

The figure represents total expenditure on health, by area of expenditure, 2011-12 ($ billion)

The second largest health spending was for primary health care services, $50.6 billion, or 36.1% of total health expenditure. Primary health care includes a range of mandatory health services – GP services, physiotherapists, optometrists, and dental servicesetc. It also includes the cost of medications not provided through hospital funding.The rest of the health spending was for other recurrent ($28.3 billion, or 20.2% of total health expenditure) and capital expenditure ($ 7.9 billion, or 5.6% of total health expenditure). ‘Other recurrent’ includes the amount of recurrent spending that were not paid for by hospitals and that were not delivered through the primary health care services. But rather, those were provided by general practitioners, medical research, health aids and appliances, patient transport services and health administration.

Both the private and public hospital services received a total amount of $53.4 billion in 2011-2012.

The primary funding sourceswere state and territory governments ($22.9 billion, or 42.8% of total hospital funding) and the Australian Government ($19.5 billion, or 36.5%). Even Non-government sources provided an additional $11.1 billion (20.7%). During 2011-2012, there were around 1,345 hospitals in Australia, out of which 753 public hospitals accounted forabout 68% of hospital beds (58,420) and the 592 private hospitals accounted for about 32% of beds (28,351, based on 2010–11 data).

Health campaigns and other promotional activities

Australia is known for promoting health related campaigns. There are end numbers of campaigns to create awareness, some of them are stated below,

- Life- Started way back in mid-1970s with an animated character named ‘Norm’, this campaign aimed at promoting healthy lifestyles

- Slip Slop Slap- Started in 1981 to promote awareness of skin cancer

- The Grim Reaper campaign- This campaign aims at promoting HIV awareness. It was started in the beginning of 1987.

Tick endorsement program- The National Heart Foundation started this campaign in the beginning of 1989, to promote healthy eating.

- ‘Every cigarette is doing you damage’- It is a part of the National Tobacco campaign and aims at promoting anti-tobacco movement.

There are numerous other campaigns which focus on topics like- free milk for school children, polio and other vaccinations, proper seat belts in vehicles, include folic acid in the breads for healthy development of kids during pregnancy, promote iodised salt to reduce thyroid related diseases and plain packaging of tobacco etc.

There are separate initiatives to promote well-being of the citizens. There are special campaigns by the Australian Government that focus on issues like sexually transmitted diseases, illicit drugs/alcohol/tobacco addiction, cancer screening, psychological issues, obesity, immunisation and HIV/AIDS.

Source: aihw.gov.au

Success of these campaigns

All the initiatives and campaigns taken by the government or non-government organisations have worked toward better life quality and increased life expectancy. Over the years, Australia has seen major improvements in tobacco control, alcohol addiction, skin cancers, immunisation, HIV/AIDS control, sexually transmitted diseases and cardiovascular diseases, etc. These campaigns promote prevention by reducing the chances of disease, injury and disability. It allows proper utilisation of the health resources, promotes a healthier workforce and supports better sustainability. Citizens who followed them regularly have experienced better personal and professional lives by reducing chances of injury, disease and conflicts.

There are a significant number of people have reduced smoking in Australia. Anti-tobacco campaigns, increased taxation and regulations played important roles in reducing smoking among men and women. Since 1970s and 1980s smoking-related death has reduced by 40% and chronic pulmonary diseases by 60%. SIDS related death fell by three-quarters, from an average of 196 deaths per 100,000 births during 1980-1990 to 52 during 1997-2002. Road safety campaigns have saved more than 1,000 people.

Source: abc.net.au

Emergency health care services in Australia

The emergency services provided by public hospitals in Australia are expanding. Currently, public hospitals are providing more than 7.8 million emergency services and the number is increasing by 2.4% on average each year. Also, the number of public hospital emergency department presentations has increased by an average rate of 4.3% each year.

Still, Australia needs more emergency health care services. During 2007-2008 and 2011-2012, there was around 8% increase in the number of emergency patients who needed special care within 10 minutes. Also, a 6% increase was recorded in the number of patients who needed special care within 30 minutes. At the same time, the number of emergency department presentations that were treated within an appropriate time has increased from 69% to 72% and the median waiting time reduced by 3 minutes.

Admitted patient care

During 2011-2012, there were around 5.5 million people were admitted in public hospitals and around 3.7 million in private hospitals. Since 2007, the number of separations has increased by 3.8% for public hospitals and 4.6% for private hospitals. During the same period, the number of emergency cases increased at a higher rate than overall for public hospitals and at a lower rate for private hospitals. (4.1% and 3.2% per year). Citizens aged 85 or above contributes around 9% of all separations.

Surgery

In 2011–2012, out of 2.4 million patients who required surgeries, around 295,000 were emergency admissions. The mainland Australia (13 per 1,000 persons) recorded a less number of emergency admissions as compared to the Indigenous Australia (25 per 1000 persons). On the contrary, Indigenous Australians had recorded less than two-thirds the rate of other Australians (54 per 1,000 persons and 87 per 1,000 persons) when it came to elective admissions.

The aged care industry is facing a shortage

A recent report states that Australia will face a shortage of 280,000 aged-care places by 2050! This report was done by Alzheimer’s Australia. The report found that demand would overcome the available facilities by 2050. There will be around 1 million patients diagnosed with Alzheimer by 2050. According to John Watkins, CEO, Alzheimer Australia, the reformed policy should recognize the extra pressure and additional costs placed by dementia care. Aged care providers claim that the sector is facing lack of skilled labour force and funding. Dementia is one of the greatest challenges for the aged care sector in Australia. And for which more people are seeking for residential aged care.There is a prediction that currently around 220,000 people are suffering from it, and the number will increase to 730,000 in 2050.

According to the peak body representing providers- Leading Aged Services Australia, there will be a shortage of 66,000 home care places by 2050 and there will be a need of 83,000 new nursing home places over the next nine years. They predict that theaged care sector would struggle to sustain the supply since the number of people over 65 doubles to six million by 2050. While the policies and campaigns are effective in promoting good health and longer life expectancy, Australia still need to expand its capacity to provideaged services to the increasing number of users.

The aged service workforce is currently employing around 350,000 people, which will need to be tripled by 2050 to match the increasing demand for care. The majority of them are over 45 and a third nearly reaching retirement.

The government need to put more money into the workforce so that more people can be hired and new healthcare facilities can be built.The federal government recently announced that an approximate amount of $1.2 billion would be spent on the aged services to improve the conditions for aged care workers and to provide them better facilities. According to Robert Orie, chief executive of aged care provider Montefiore, existing services were already stretched further to their limits. “We really rely on appropriate aged care funding, but in real terms the funding has decreased,” he said. It’s gone up in dollar terms but that’s mostly because our clients need more care. We are expected to do more with less funding.”

The future expectation is to increase the number of home care places to 100,000 in the next four years and to increase the number of nursing home beds to 80,000 in the next ten years.

Source: Cepar.edu.au

Conclusion

Scope of Demand for Aged Care

Australia has a greater need of residential aged care services in coming time. Also, we would be needing a much skilled workforce that incorporates medical, nursing, counsellors, carers and allied health professionals. Forecasts of the growing life expectancy have a big impact on the market for retirement villages, since the aged community is expecting better lifestyle. The retirement villages need to implement better internet service, upmarket dining, and community-based care. Due to demographic ageing and increase in income and expectations, the aged care system is experiencing rapid demand growth. These factors are constantly predicting the fact that the Australian Government’s spending on aged care services will be more than double the amount of the national income over the period of another three years. The need for formal aged care services and the real cost of public provision is growing much faster than population growth and national income. The policy makers need to concentrate on a larger expansion community packages and investments from outsiders.

The demand for care will rise because of population ageing, but assessing the necessary facilities to cope with the demand has become complicated. One difficulty is that demand can potentially be driven by supply, so the starting point must relate to expressed need. Older people tend to have disability-related problems, so a greater number of older people would require services like home care, after-hospital care and carer counselling.

Aged care is an integral and growing component of the healthcare system, as it is directly related to the ageing factor of our population which is constantly on the rise. The current scenario is dominated by conflicting claims about thescarcity of funding levels for aged care, as providers reporting low returns. Although, there is an adequate amount of qualified staff, there are difficulties maintaining the infrastructure investment. The Australian national seniors expect prompt action that includes an innovative policy to ensure easily accessible and highly sustainable aged care services in near future. This would require consideration of alternate funding sources and the integration of aged care services within other broader health and hospital system. Australia’s ageing population will be putting substantial pressure on the aged care industry, as not only will there be a greater number of people needing aged care but they represent a major portion of the total population.