The Lucrative Benefits Of Investing In Commercial Real Estate

Introduction

The Year 2016 looks pretty promising for Australians to invest in real estate. Australians are lucky to possess one of the most robust property markets in the world. For a very long time, Australia has had the record of the highest homeowner occupancy rate among the developed countries. Australia’s two-way trade in goods and services in 2014 totaled A$664 billion, making up about 42 percent of GDP. Australia’s trade with Asia-Pacific Economic Cooperation countries always remain strong. About 73% of Australia’s total trade with a value of around A$483 billion comes from ties with Asia Pacific nations. It has always remained as a significant market to trade, with total export values reaching over A$100 billion, or 15 percent of Australia’s two-way trade, in 2014.

Recently, Australia is titled as one of the top 15 destinations for global foreign direct investment (FDI) stock, with a 2.2 percent share of the global stock of FDI. Australia received US$ 565 billion in FDI in 2014, a remarkable rise from US$ 291 billion in 2004. The FDI in Australia always remains strong on the backdrop of strong economic expansion.

The number of international visitors to Australia rose by 7 percent to a new height of 6.6 million in 2014-2015. Again, visitors from the Asian region have outnumbered others as it is accountable to more than 60 percent of Australia’s total number of tourists. There were 864,000 visitors from China alone in 2014-2015. There was also strong growth in visitors from the United States (up 9 percent at 544,000).

Investing in commercial real estate is relatively a new trend among Australians. According to a recent report by Deloitte, cities like Sydney, Melbourne, and Hobart show impressive occupancy rates, as international and domestic tourism continues to grow in Australia.

Source: www.tradingeconomics.com

In this article, we will guide you through the benefits of investing in commercial real estate and the factors influencing them. We are highlighting the following topics of discussion:

- Sydney as the chosen destination by the expats

- The growth of the hospitality industry in Australia

- Why travellers opt for serviced apartments

- Why commercial real estate is termed as the hotspot for investors

- The objectives of investing and the factors that influence demand for commercial real estate

Expats choose Sydney as their destination

Sydney takes the winning role as a chosen destination by the expats. As the city welcomes its guests with a dynamic and world-class cosmopolitan culture. It is a city known for its breathtaking natural beauty and a multi-lingual spirit conflate to afford a high quality of life to the residents. There are never-ending benefits available for all the spectrum of lifestyle to the expatriates moving to Sydney. For example, picturesque residential suburbs, well-maintained public transport systems and easily available state-of-the-art healthcare facilities. There are world-class educational institutes which provide higher standard of education, right from the elementary to the tertiary level. These are some of the reasons why Sydney has turned into a lucrative destination for those who are seeking quality education.

The city is also blessed with a mild climate and amazing outdoor pursuits. The city also encourages those who are into arts and culture, with a wide array of fine galleries and museums, theatre productions, and a magnificent selection of restaurants and lively café culture. There are festivals all around the year for almost every occasion and major concerts happening every year. Sydney can be also considered as the major financial hub of Australia, employing one-third of Australia’s financial sector workforce. Most of the major business houses of Australia are situated in Sydney such as The Australian Stock Exchange and the Reserve Bank. Even some of the IT biggies have made Sydney as their chosen hub of operation. Thus, there is no surprise that the number of expats relocating to Sydney for work purposes continues to increase and in effect may have contributed to the increase of expenses within the city.

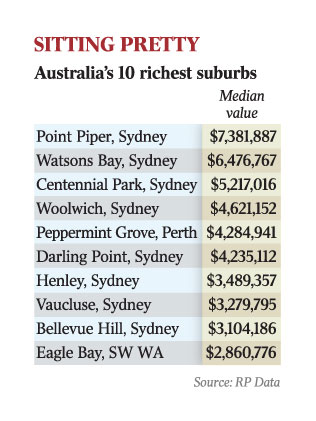

The cost of living in Sydney is much higher as compared to other major cities in Australia. Everything, starting from accommodation, transport to entertainment are pretty expensive. But this expensive tag comes with a promise to offer a better quality of life and solace since beaches and national parks are only a stone’s throw away from the city. Currently, Sydney prides itself for being the 8th of the 10 richest suburbs in Australia with the median value of a home ranging from $3.1 to $7.3 million, demonstrating its leadership in real estate and robustness of its economy.

Source: www.theaustralian.com.au

The Rise of the Hospitality Industry

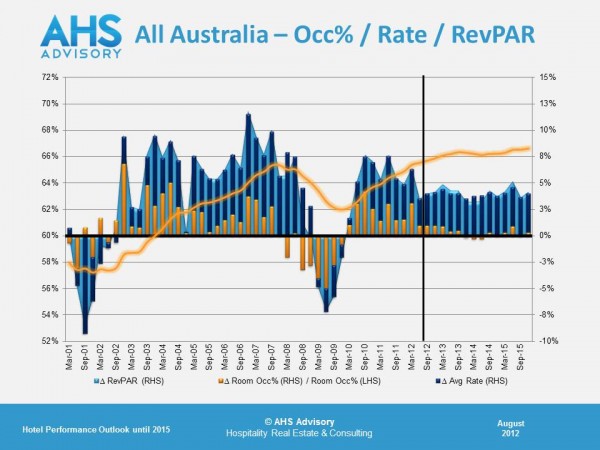

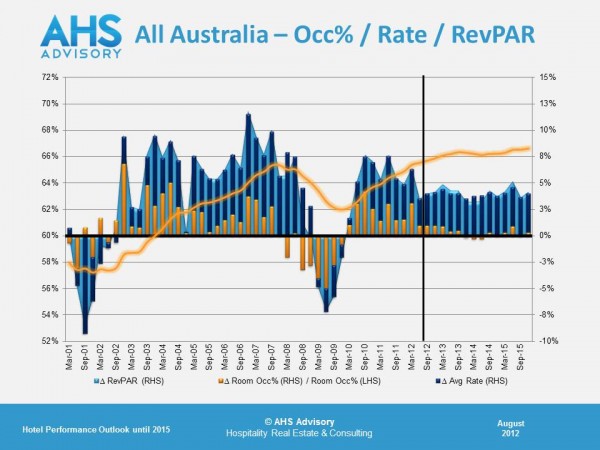

As the Australian economy is slowly changing from a growth phase underpinned by resource sector construction to a more diversified one, travel patterns are gradually shifting away from the big mining cities to other places. Strong demand growth, coupled with big investment pipeline, is pushing hotel occupancy further into record territory nationally and across several individual markets. Big cities like Sydney and Melbourne record the highest occupancy rates, followed by Brisbane and Perth.

Source: www.ahsadvisory.com.au

In 2013, the Australian hotel industry saw a heavy growth in RevPAR (average room rates and key indicator of revenue per available). It has grown faster than the average rates in cities like Sydney, Melbourne, tropical north Queensland, Darwin, and Hobart. By the end of 2016, the average rates are expected to climb to 68.9% from 66.8%. The Deloitte report predicts that the long term investment plans are comparatively higher than the last two years with around 66 projects being underlined. Due to the strong presence of the Australian dollar, the tourism industry has seen growth in several sectors.

According to data derived from STR Global in June 2015, average growth in RevPAR across major cities was 1.2 percent, but it varied according to the markets of course. The highest national RevPAR was recorded at 20.8%, Sydney City at $196.33 showing growth of six percent. Surprisingly, the strongest annualised growth in RevPAR occurred in Cairns which increased 10.2 percent to $89.65. The Gold Coast at 8 percent to $89.65.

The most prominent reasons for visiting Australia were- holiday (46%), followed by visiting friends and relatives (28 %) and business work (9%). New South Wales recorded the highest percentage of stay at 38%, followed by Victoria (24%), Queensland (22%), Western Australia(11%), South Australia(3%) and the remaining states at one percent each.

Source: www.ahsadvisory.com.au

This growth has a direct impact on the tourism industry across several regions. Due to global economic recovery and strong Australian dollar, the international visitor nights is expected to grow at 4.8% per year, followed by domestic visitor nights by 2% in 2017. Asia remains the primary goal driver, followed by the US and UK. Even the domestic holiday travel rate is growing since more Australians are opting to spend their vacation in Australia itself.

This new boom of tourism brings new investor groups from the US and EU to compete with the leading Asian investors. It is expected to grow more than $4 billion in 2016. According to Wayne Bunz- Director of CBRE Hotels, this year is going to be a phenomenal one since the appetite for investing in the hotel industry is growing beyond major cities like Sydney and Melbourne and spreading across leisure hotel markets such as Cairns and the Gold Coast. Last year, CBRE recorded $3.87 billion of hotel sales across more than 80 transactions, that include the sale of flagship luxury hotels in cities like Westin Sydney and Sydney Hilton. The Majority of these investors were from Asian countries.

www.finder.com.au/commercial-propert

Serviced Apartments- the traveller’s paradise

Source: www.theperch.in

Why travellers opt for Serviced Apartments

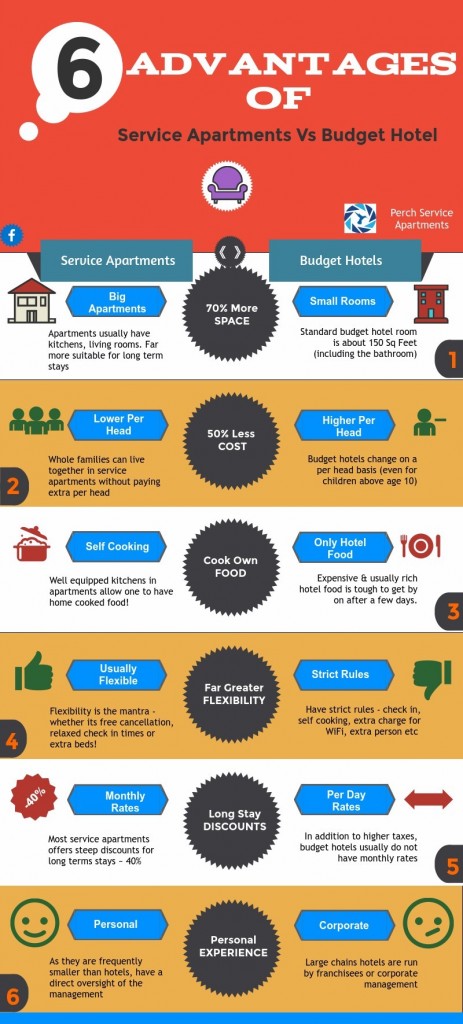

Recently, more and more travellers are opting for flexibility and freedom provided by the stays when they are away from their homes. Serviced apartments are generally used for extended stay purpose. The reason why many tourists choose serviced apartments is that it offers great value for money and freedom. More often than not, tourists could also be families or people travelling on business.

Serviced apartments offer similar services as compared to hotels, but with a bigger space, more privacy and a higher level of comfort. It almost turns into a full residential property, providing perfect accommodation solutions for both short-term and long-term stays.

Let’s explore the major advantages below:

Space: Typically, serviced apartment are 40-60% bigger than typical hotel rooms. It includes basic amenities such as the kitchen, the bathroom, living areas and the facility to do your own laundry. Some even raise the bar by adding luxuries such as private bar, spa or even a pool.

Price: They cost much less than the average hotels especially during a medium or a longer stay period.

Flexibility: A serviced apartment offers you personal freedom. You can call and entertain your friends and visitors at your own convenience and at your own expense. You can have your own workstation to have your business meetings. You are no longer restricted by the hotel timing and house rules.

Location: Serviced apartments most often are conveniently located in the areas which are close to public transport, business houses, restaurants, and entertainment spots.

Serviced apartments are expected to outperform hotels in the next three years.

According to a recent study done by Atchison Consultants, three years from now the total returns for serviced apartments will be 13%-15% while total returns for hotels are expected to range between 10%-11% per annum. The report states that occupancy rates will reflect growth in GDP, which would remain constant and rental growth will be in line with CPI. According to another report by Jines Lang LaSalle Hotels (JLLH), out of 3,712 hotels under construction at the end of September last year, a third were serviced apartments. The consumers are eagerly showing their interest over the apartment-style product.

Serviced apartments almost look like residential properties but free from typical rigidities such as vacancies, repair and maintenance charges, real estate agents and property management fees etc.

According to Atchison Consultant, 50% of business travellers in Australia prefer to stay in serviced apartments. There has been a significant increase of 10% in the number of business travellers last year, the growth rate was stagnant at 4.6% in the last 10 years. The condition is highly stronger in some of the large cities, which are enjoying the benefits of business travellers. The performance of serviced apartments depends on the continuing growth in corporate level.

There is a significant increase of 72% in the number of room nights sold in serviced apartments since 2011. This sector is highly fragmented and no one has a defined market share. Some of the key players are as follows,

- Quest (6%)

- Oaks Hotels and Resorts (5.7%)

- Mantra Group (5.1%) and

- Mirvac (3.2%).

Since the beginning of 2009, the occupancy rates have always averaged above 80% and this is expected to grow in coming time. This growth spurt has occurred since the Sydney Olympics with the number of serviced apartments with 15 rooms or more growing from 479 in 1998 to 973 in 2011. According to Atchison Consultants review, “Investment attributes of serviced apartments include direct property exposure with a relatively affordable price entry point, usually on a long-term lease with contracted periodic rental uplift, tax, and depreciation benefits and alternative use through conversion to residential.’’

By the end of 2011, the Australian service industry consisted of approximate 1,200 operators with more than 1,300 establishments and employed more than 16,000 employees. Currently, the estimated value of the serviced apartment sector is $8 billion. The most lucrative part is that investors can buy serviced apartments and lease it to the accommodation business.

Looking to invest in Australia? Think about commercial properties

Serviced properties fall under commercial real estate. Commercial real estate is primarily used for business purposes and can be classified into three categories: retail, office and industrial. Like any other kinds of investment, there are risks involved when it comes to investing in serviced apartments and each has its own cycle of risks and rewards. However, they promise considerable amount of returns. By investing in a commercial property, an investor can earn return up to 10%. The primary benefit of investing in a commercial property over a residential property is that it could have longer leasing covenants that lasts from 3-10 years, with fixed and CPI annual increase. There are many benefits of investing in commercial property over residential ownership. Let’s discuss them below.

- A guaranteed rental income

- 100% assured tenancy

- Long term lease agreements

- Tax and other annual benefits

- No management fees or letting fees

- Hassle-free repair and maintenance issues

When it comes to investing in commercial property, many investments are subject to the uncertain market conditions, that can be volatile to the investor. But investing in serviced apartments can be defined as a good SMSF investment (Self-managed super funds), which maybe a safer way to invest and there are considerable amount of benefit associated with SMSF investment.

The main attraction of commercial property lies in its ability to promise high rental income. The demand for the best commercial property is usually found in those areas where the population is high and there are increasing demands from the residents to be conveniently close to local amenities such as supermarkets, and places that offer goods and services. If you are the kind of investor who has earned enough money to sustain yourself and is looking to earn income by sitting at home, then commercial property would be the right choice for you to invest.

The objectives of investing in a commercial property

Why do you want to invest in a commercial property? Its important to know your investment objectives.

- Portfolio diversification – Do you want to invest because you want to diversify your portfolio and minimise your investment risk by purchasing a different property type in a different area?

- Income – Do you want to maximise your return on investment? If yes, then what are your expectations? Have you looked at average rental yields for similar properties in the same area?

- Capital growth – Do you want to achieve capital gain through your investment? If yes, then how much do you hope to gain and by when?

- Tax benefits – Many of the investors, invest to claim tax benefits such as claiming back GST and losses, are you one of them?

- Degree of risk – Become familiar with the risks associated with your investment and be aware of local price and market conditions before investing in commercial real estate. It also helps to know the council restrictions and zoning regulations. Check the condition of the property if it meets the necessary standards and regulations.

- Terms and conditions – You should be capable enough to manufacture favourable terms and conditions for both the parties. There are a few important aspects you need to take into consideration while making a contract. Some are as follows: finance, approvals from the local council, cash flow and the period required to get approvals.

- Location – Select the location of the property carefully. It would be much favourable to be reasonably close to transport hubs, business centers and other public facilities such as hospitals, universities and employment centres. Also, make sure that there is no oversupply of similar properties in the area.

- Infrastructure developments – Log into the local council website or try contacting local agents to know detailed information about the current infrastructure plans that are underway. Also consider future infrastructure developments that can put pressure on property prices.

Factual differences between commercial and residential property investment

In general, when you invest in commercial property, you wish to rent out the property to a tenant and expect a rental income out of it. The same thing you may do when you invest in a residential property. However, there are significant differences between the both, some of them are mentioned below,

- When it comes to a commercial property, the tenant is termed as a Lessee

- Leases are meant to last for a longer period of time with rents reviewed annually

- Vacancies can be longer in terms of changing the Lessee

- Goods and Services Tax, both are applicable to a commercial property

- All kinds of maintenance costs are usually paid by the lessee for which net rental income becomes much higher

Source: http://www.yourinvestmentpropertymag.com.au/

http://www.propertyobserver.com.au/

The factors that influence demand for commercial real estate

The most prominent factor in commercial property growth is demand, which is hugely driven by a host of other economic factors. A few of them are mentioned below:

- Interest rates – If the interest rate is low in the environment, it will support demand for both property and borrowing. Rising interest rates would lower the demand for commercial real estate as the cost of finance and rent becomes more expensive.

- Size of the Infrastructure projects – Bigger infrastructure projects could call for the demand of commercial property. Take the development of M7 in Sydney as an example, which generated big demand for warehouse properties in surrounding areas.

- Population demographics – Population demographic may influence the demand as well. For example, Australia’s ageing wave of baby boomers has greatly increased demand for health care services such as aged care facilities and medical centres. For example, federal government expenditure on health care services and facilities is expected to increase from 15% of total Commonwealth expenditure to 25% by 2050.

- Population growth – The growth in population demands a lot of expanding services such as shopping centres, eateries and financial service companies. Henceforth, the suburbs with strong population growth calls for an equally strong commercial real estate growth.

Conclusion

The serviced apartments industry has seen a strong growth over the past five years. The industry has consistently taken market share away from other operators in the hospitality sector such as hotels and motels. The most prominent reasons are being low rates charged by the service providers, better in-room facilities and absolute privacy. The growth of serviced industry closely followed Australia’s tourism patterns and as a result of which, most of them are situated at major business hubs and holiday destinations. In places like New South Wales, Victoria and Queensland, more than 75% business establishments are comprised of serviced apartments.

The above mentioned information draws your attention to the importance of properly understanding and managing associated risks. These information will help you take informed decisions, especially when he will move into larger commercial deals. We talked about some of the major factors that play a significant role in moving the commercial real estate market in Australia and some of these aforementioned factors suggest a relationship between the condition of the market and the investment. However, understanding the key factors that drive the demand for the commercial real estate market is mandatory to perform an evaluation before you decide to invest.